As the Red Sea continues to witness ongoing attacks on commercial vessels by Houthi rebels, the prospects for resolving the conflict appear more distant than ever.

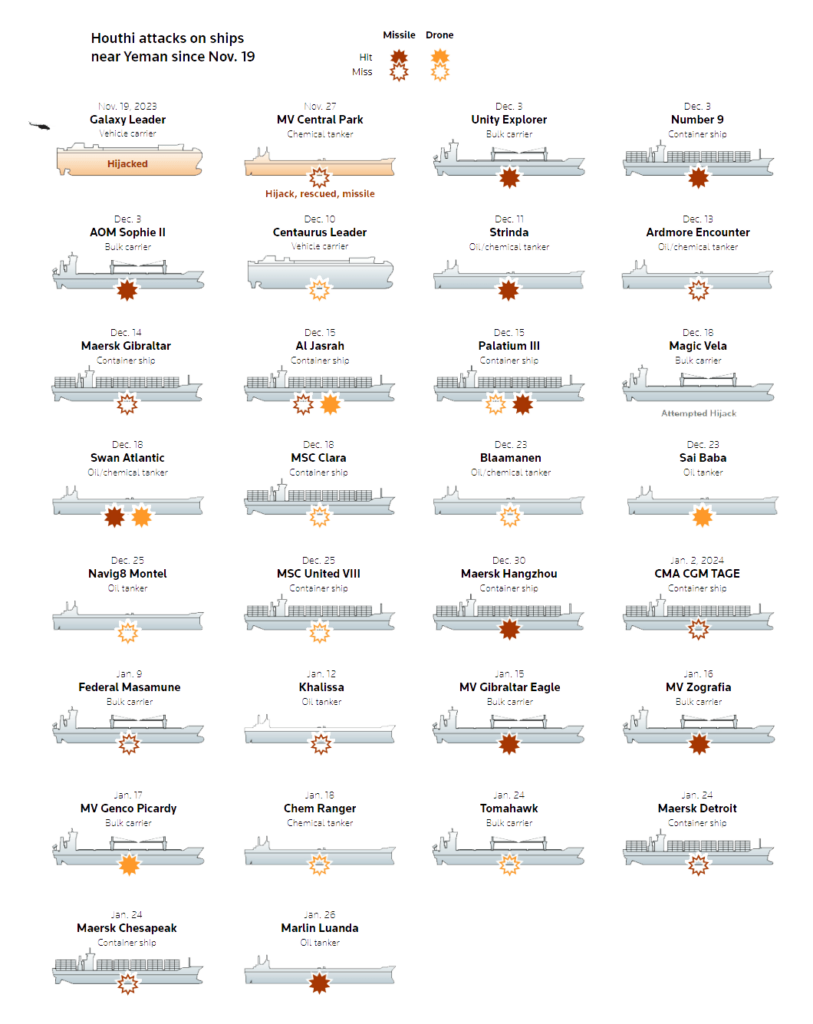

The first attack occurred on 19 November when Houthi rebels hijacked the Galaxy Leader, which was traveling through the Red Sea. They took control of the vessel and redirected it to Hodeidah port in Yemen, where it remains under their control along with the crew. Since then, more than 35 commercial vessels have been targeted in a series of escalating attacks, which have intensified in response to US and UK-led military actions against Houthi infrastructure.

Reports from Reuters shed light on the nature and frequency of these attacks, revealing that the utilization of simple methods like drones makes it extremely difficult to prevent them entirely, as seen in the image below.

Added to this, according to Reuters, the narrowness of the Bab al-Mandab strait, where most attacks have occurred, allows the rebels to quickly retreat to shore, leaving naval forces primarily engaged in preventative measures.

As a result, the industry anticipates a mid-term scenario where transit times between East and West will be affected, as vessels are forced to take alternative routes via the Cape of Good Hope instead of utilizing the Suez Canal.

It has been noted that this volatile situation has prompted industry players to adjust their strategies and revised schedules to reflect the new routing, resulting in longer transit times compared to before the conflict erupted.

Meanwhile, the short-term rate development in the shipping market has seen only modest decreases, contrary to expectations, at the Lunar New Year period. This can be attributed to the surge in volume prior to the temporary shutdown of factories in China for the festivities.

While some rate levels have dropped slightly on various trade routes, overall rates remain elevated compared to Q3 and Q4 of the previous year. It is believed that a balance needs to be struck between carriers' need for sustainable operations and avoiding operating at a loss.

As the Lunar New Year passes, it is anticipated that short-term rate levels will decline further, although the pace of this decline remains uncertain. In terms of long-term rates, those for Asia-Europe trade are still based on negotiations from late Q4 of the previous year, but additional charges such as war risk, operational recovery surcharge, and peak season surcharge may apply.

The timing of when these surcharges will diminish remains unclear, given the significant gap between current short-term rate levels and those negotiated in Q4 of the previous year. However, it is expected that the recent surge in rates is a temporary phenomenon driven by the rush before the Lunar New Year and the delays caused by the Red Sea conflict, prompting shippers to turn to airfreight to avoid supply chain disruptions.

Historically, the price difference between ocean and airfreight has played a role in such situations, as high ocean freight rates make airfreight comparatively more affordable and cost-effective. Additionally, the cargo airfreight market has been showing signs of improvement in terms of volume, following a challenging period during the pandemic.

It is important to note that the information provided is subject to change and is based on the best available research.